medTRANS 2025 Year in Review

A year of learning, leadership, and building something stronger together.

As we close out 2025, the medTRANS community has a lot to reflect on. This year brought new challenges, new data, and new opportunities to understand what truly drives a high-performing captive. It was a year of sharpening our strategy, strengthening our structure, and doubling down on the fundamentals that have shaped medTRANS for the past 15 years.

Our members continued to prove that when employers come together with transparency and purpose, they can create something more resilient and more effective than traditional commercial insurance alone. This year showed us not only where the industry is heading but also how medTRANS is helping lead that evolution.

Below are some of the most important lessons from the past twelve months and what they mean for the future.

What We Learned These Past 12 Months

Frequency of Severity Increased

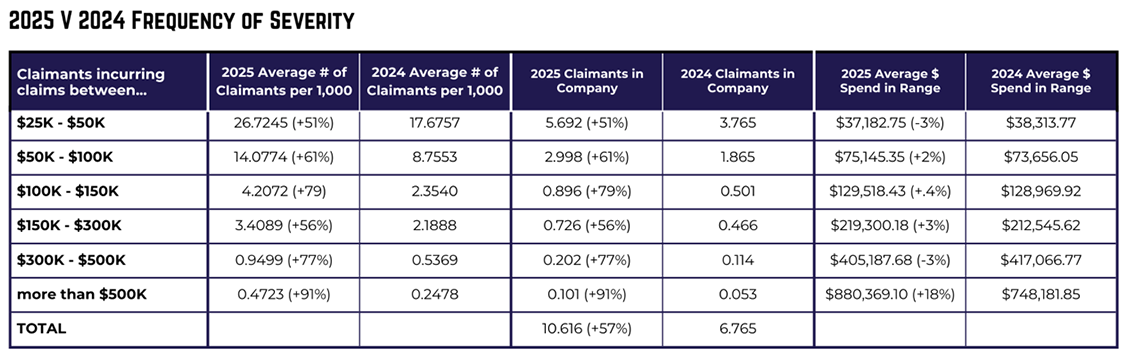

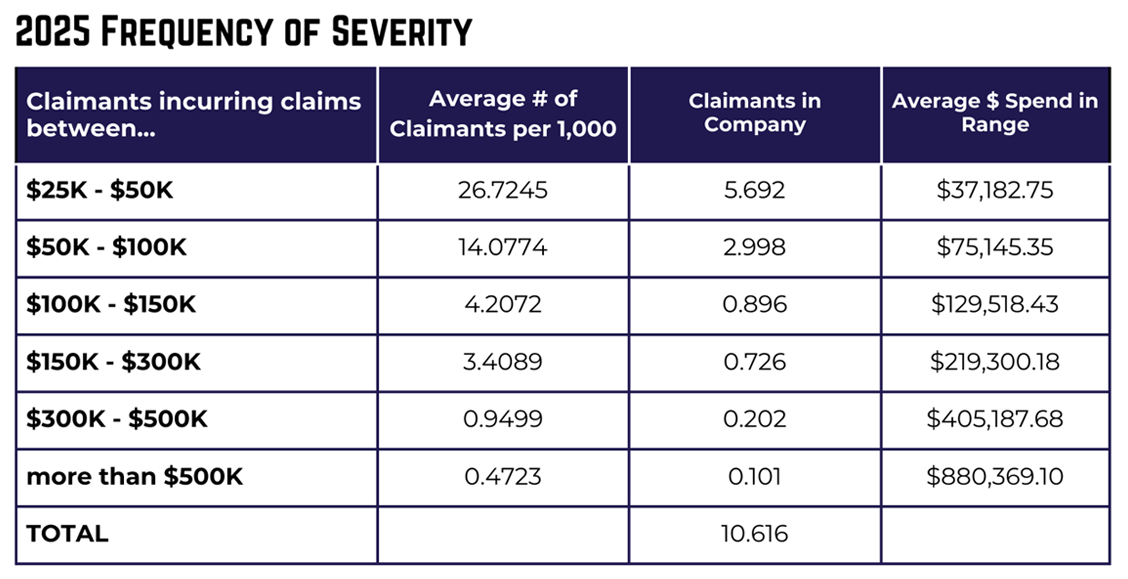

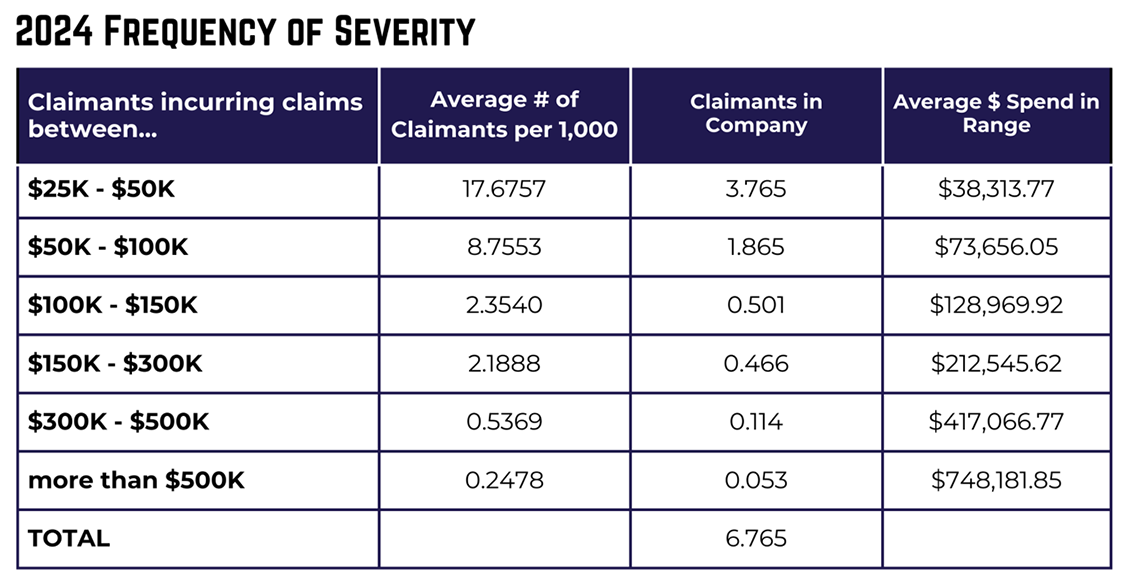

This year’s data confirmed what many across the insurance industry have been discussing. The frequency of severity, especially within high-cost claim bands, rose sharply for our members. When comparing 2024 to 2025, the increase ranged from 40 percent to nearly 90 percent, with high-cost claim frequency close to doubling. We first saw this shift emerge in the third quarter of 2024 and it remained consistent throughout 2025.

The frequency of severity model is central to stop-loss rate development. It accounts for both claim frequency per 1,000 employees and the average claim value within each band. Carriers then add administrative expenses and profit targets. A simple example shows the impact. If the model calculates $500,000 in needed premium and the carrier applies 20 percent for administrative expense plus 7 percent for profit, the cost becomes $635,000.

In response to rising severity, medTRANS has focused on managing these claims more actively and more assertively. That strategy has produced measurable success and continues to be an area where engaged membership directly improves captive performance.

Investment Committee Importance

A few years ago, when interest rates reached ten-year highs, we saw firsthand how essential a strong Investment Committee can be. As a captive manager, medTRANS does not provide investment advice, and historically the primary focus was negotiating a stronger money market rate on premium deposits.

When the committee chose to rebuild and strengthen its Investment Policy Statement, returns began to rise significantly. In late 2023 the bank offered 2.75 percent. By the third quarter of 2025, medTRANS was earning nearly 8 percent on millions of dollars while maintaining appropriate risk controls.

That return does not fund claims. Instead, it goes back to members. The lesson is clear. Every premium dollar should earn a return, whether the captive is single-parent or group-based. Investment committees matter, and a strong policy can turn opportunity into real financial benefit.

Operational Efficiency Is Essential

Efficiency remains one of the clearest indicators of a healthy captive. Premium rate development always begins with frequency of severity plus administrative expense. While frequency of severity tends to be consistent across insurers, administrative expenses vary widely.

If one carrier applies 15 percent general and administrative expenses and another applies 20 percent, the difference is a 25 percent swing in cost. On a $500,000 cost of risk, that produces premiums of $575,000 and $600,000, respectively.

Reinsurance captives face a unique challenge because both the fronting carrier and the captive incur their own administrative expenses. If the carrier is at 15 percent and the captive is at 5 percent, the total administrative load becomes 20 percent.

For captive investors, understanding efficiency begins with requesting the combined ratio. This ratio represents the sum of claims and administrative expense. A combined ratio above 100 percent, without a strong justification, should raise immediate concerns. Investors should ask what portion of the ratio is claims and what portion is expense. Many program managers cannot answer this question. That alone is a signal to pause.

How to Be a Better Captive Investor

Let Facts Pave the Way

Captives reward long-term thinking. Much like the broader insurance market, performance tends to follow a pattern. Over a five-year period, most employers will experience three favorable years and two challenging ones. When you add total premium over five years and compare it to total claims, the premium almost always exceeds the claims. That is how carriers generate reliable profit.

Captive investors need to commit at least three years to allow the model to work. Captives are not vehicles for short-term speculation. They succeed when investors understand the fundamentals and stay engaged.

Cut Through Sales Propaganda

Captive program managers may present their programs with enthusiasm, which is not necessarily a bad thing. However, investors need to ask the right questions. Only a captive manager can create a meaningful set of questions that helps identify real value rather than surface-level excitement. Facts should lead every decision.

Talk to Technicians

When facing legal issues, you consult an attorney. When managing taxes, you seek the advice of a CPA or tax attorney. When investing in financial markets, you rely on a CFP. Captive investment is no different. The technical side of captive operations deserves technical expertise. Investors should speak with the people who understand regulation, accounting, structure, and risk. Program managers can offer a broad view, but technicians provide the depth that leads to sound decisions.

Captive Lexicon

Captive Manager vs Captive Program Manager

A captive program manager oversees the broader picture. This person understands the program’s experience, values, governance, and long-term vision. Their knowledge is wide but not deep. A captive manager, on the other hand, specializes in the technical mechanics of how a captive operates. They support regulatory reporting, financial accuracy, and structural integrity. Their expertise is deep but focused. Both roles bring value, but they serve very different purposes.

Bordereaux Report

In a reinsurance captive, the fronting carrier issues the policy and receives premiums. The captive must maintain its own financial statements for regulatory purposes, but the premiums are held by the carrier. A bordereaux report shows how much premium is on deposit, the fees charged by the carrier, and the amount available to pay claims. It is the first report investors should request because it reveals the true administrative expense of the fronting carrier.

Capital vs Collateral

Capital and collateral are not the same. Collateral is posted with the fronting carrier each year to protect the carrier’s assets and is required for regulatory reporting. It is not a business expense. Capital, by contrast, is required by captive regulators. It represents surplus and can be used to fund claims if needed. While not an expense, capital may create equity that flows to the insured’s balance sheet. Understanding the distinction is essential for any investor.

A Year of Growth and Gratitude

2025 marked the fifteenth anniversary of medTRANS and another year of building something fundamentally different from commercial insurance or BUCA plans. What began as a group of EMS association members searching for relief from rising health costs has grown into an innovative, member-owned captive that prioritizes transparency, control, and shared success.

Along the way, medTRANS evolved from its earliest model to what members now know as medTRANS 2.0. That shift required trust, partnership, and a willingness to rethink traditional structures. Today, the captive operates with cell structures that allow each participant to manage savings, spending, and profit repatriation while benefiting from the strength of a shared model.

Real savings have always come from engaged members who take ownership of risk and claims. Education at the annual meeting and guidance from experts, including the clinical and strategic insight of Jamie, have played a meaningful role in improving outcomes and deepening understanding among advisors and employers.

This year reaffirmed that medTRANS is strongest when members collaborate, stay curious, and lean into the details that truly drive cost control. We are grateful for the commitment of every employer, consultant, and partner who continues to help make this captive special.

Looking Ahead

And do not forget. The medTRANS Annual Membership Meeting is coming up March 15 through 18, 2026 in Amelia Island, Florida. It is our yearly opportunity to learn, connect, and share insights with captive members, consultants, and industry specialists. Check event details here.